Manulife Economic Corporation (MFC) is predicted to announce its 3rd-quarter earnings figures on the 11th of November. $.53 in earnings for every share is the consensus bottom-line quantity for the 3rd quarter. In the next quarter, management introduced earnings of $.59 for each share which was a convincing $.13 beat above consensus for that quarter. Despite the fact that shares rallied briefly on the back again of that Q2 earnings beat (where shares remained over $15 a share for the latter element of August), they have come suitable back again down to near to the $14 level as we head into November.

CEO Roy Gori on the hottest 2nd-quarter meeting contact again honed in on the firm’s 5-position approach. Gori reiterated that the firm’s objectives have not modified inspite of the adverse ramifications of the coronavirus pandemic. Let us go via the priorities and see if the fundamental development in the recent next quarter brought the organization closer to its aims or more absent from them.

- The very first priority Gori pointed out is to enhance the portfolio by means of active management. The CEO described that $285 million of money advantage had been understood so significantly above the first two quarters. This is very good information for buyers as Manulife in result has by now realized its portfolio optimization targets. So, we unquestionably have a good trend having position in this first precedence.

- The second precedence is to be aggressive on bringing down charges. Once more, we saw good tendencies consider position in this article in the 2nd quarter. Thanks to being ready to respond promptly to the headwinds in the 2nd quarter, core bills dropped by 5%.

- The third precedence is all about doubling down on Manulife’s corporations with the most opportunity. The two major segments listed here are the International WAM (Prosperity & Asset Management) business enterprise as effectively as Asia. Manulife carries on to improve its selection of brokers in Asia as well as total promotions in buy to encourage its merchandise and products and services in foreign markets.

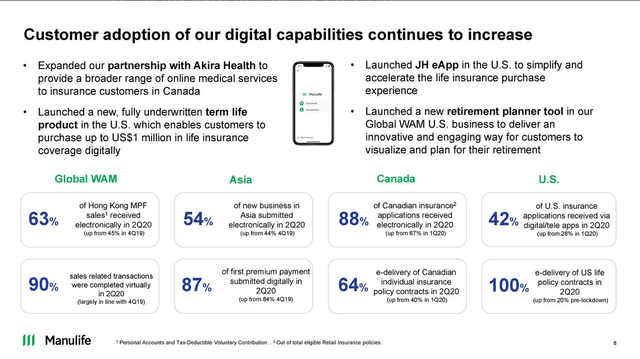

- The fourth priority is all about the purchaser and how Manulife has been strengthening its technologies with regard to how its clients communicate with the business. As we mentioned in a former article, the pandemic seriously accelerated the shift into electronic as alternatives became far a lot less in the course of the original element of the calendar year. As we can see in the slide down beneath, Manulife’s electronic capabilities go on to attain traction. From furthering the partnership with Akira Wellness to launching apps and retirement equipment, we saw constant gains with regard to shopper adoption. Once more, these developments ought to include price to consumers more than the extensive term.

Supply: Firm Presentation.

- The last priority is all about investing in the personnel and constructing substantial-general performance groups. Since the firm’s men and women are its strongest assets, Manulife’s focus on is effectively ahead of the activity in its marketplace with respect to worker engagement and commitment. It has currently been described that Manulife is a leading employer but the organization is hunting to establish on this achievement and increase its metrics even additional.

Centered on the previously mentioned, we carry on to believe that Manulife is undervalued at current.

- The firm’s income several is presently .47 and GAAP earnings many is just under 10. These quantities look incredibly desirable as opposed to the business in basic and specially so when we appear at the tendencies talked about above.

- Also, in phrases of shareholder returns, the selection of shares fantastic at this time stand at 1.94 billion and the dividend stands at 5.72%. Yet again, the traits here search favourable with the dividend possessing greater by in excess of 10% around the past 3 decades and the float continuing to lessen.

- In phrases of profitability, it is Manulife’s dollars-move which truly sticks out listed here. With over $15 billion of functioning money circulation created over the earlier four quarters, it is not astonishing to see strong developments with respect to the firm’s increasing fairness.

Thus, to sum up, with third-quarter earnings approaching, we will look to get extensive this stock as soon as a lot more. As very long as the firm’s hard cash-movement property continue on to enhance below, we see small draw back hazard in excess of the in close proximity to time period. Let’s see what the 3rd-quarter quantities bring.

Elevation Code’s blueprint is simple. To relentlessly be on the hunt for beautiful setups by worth performs, swing performs or volatility plays. Buying and selling a huge variety of methods presents us enormous diversification, which is important. We started off with $100k. The portfolio will not end until eventually it reaches $1 million.

This posting was written by

Sign up for us to increase your returns employing cycles, sentiment and volatility

https://individualtrader.internet

My identify is Jack Foley and I primarily compose and research investment commentary as nicely as trade the markets. I am Irish but are living in Madrid, Spain with my lovely wife and 2 young children. I believe to be productive at this sport, one has to have serious enthusiasm for the marketplaces and be regularly looking at and looking into content. From fundamentals assessment to complex evaluation, possibilities or futures, cash flow or cash get, long time period trading or working day trading, there is a thing for all people in the markets relying on one’s respective targets. “Starting with the end in mind” is a great mindset to start off your financial commitment vocation with regard to ascertaining exactly what you want to get out of the marketplaces. Publish down what you want and how swiftly you want it. Thus relying on the money you are setting up out with, you will then know what degrees of threat you need to take. Regardless of what question or question you might have, I’m in this article to assistance. Shoot me an electronic mail in the speak to tab and I am going to come back again to you as shortly as possible

https://seekingalpha.com/author/specific-trader/investigate

Disclosure: I/we have no positions in any shares pointed out, but may perhaps initiate a extended place in MFC more than the up coming 72 hrs. I wrote this article myself, and it expresses my personal thoughts. I am not receiving payment for it (other than from Trying to get Alpha). I have no small business connection with any organization whose inventory is described in this report.

More Stories

What the 2025 US-China Trade Deal Means for You

China-US Trade Tariffs: What You Need to Know

Best Investment Strategies for Long-Term Wealth Building