[ad_1]

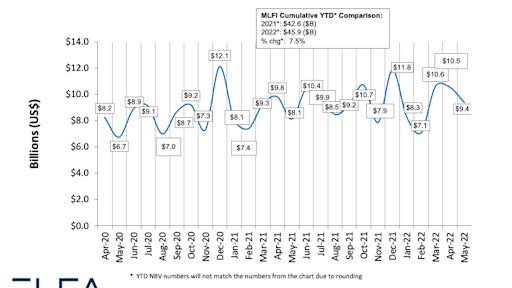

The Machines Leasing and Finance Association’s (ELFA) Month to month Leasing and Finance Index confirmed general new enterprise quantity for May well was $9.4 billion, up 16% year-above-year from new company volume in May 2021.

ELFA

The Products Leasing and Finance Affiliation (ELFA) has unveiled its Monthly Leasing and Finance Index for May possibly.

The index, which reports financial exercise centered on responses from 25 companies in the equipment finance sector, was $9.4 billion, up 16% calendar year-above-12 months from new company volume in May possibly 2021. Quantity was down 10% from $10.5 billion in April. Year-to-day, cumulative new business quantity was up just about 8% in contrast to 2021.

“May action for MLFI-25 tools finance organization members reveals sturdy origination volume and quite stable credit rating high quality metrics,” claimed Ralph Petta, ELFA president and CEO. “The financial state continues to present jobs and company America, in typical, reviews strong balance sheets—all in the experience of a waning overall health pandemic. Offsetting this fantastic information is high inflation, making havoc for numerous consumers, and ongoing supply chain disruptions and greater desire charges, which are squeezing considerably of the company sector. As a outcome, lots of equipment finance suppliers technique the summer season months with guarded optimism.”

Receivables had been 1.6%, down from 2.1% the prior thirty day period and down from 1.9% in the similar interval in 2021. Demand-offs were .12%, up from .05% the preceding thirty day period and down from .30% in the calendar year-before period.

Credit approvals totaled 76.8%, down from 77.4% in April. Total headcount for machines finance companies was down 3% year-above-12 months.

The Products Leasing & Finance Foundation’s Month to month Assurance Index (MCI-EFI) in June is 50.9, an improve from 49.6 in May well.

[ad_2]

Source backlink

More Stories

What the 2025 US-China Trade Deal Means for You

China-US Trade Tariffs: What You Need to Know

Best Investment Strategies for Long-Term Wealth Building