[ad_1]

Graphic supply: Getty Visuals

If shoppers take lengthier to pay out than envisioned and money stream is lower, you may well want to take into consideration debt factoring. Master far more about credit card debt factoring, what it will involve, and if it is ideal for your company.

Each individual tiny enterprise proprietor commences their organization organizing for accomplishment. But in company, as in lifetime, a lot of unforeseen items can take place that toss a monkey wrench into even the best-laid designs.

Matters like unexpected fees and gradual-paying out shoppers can result in funds stream to drop to harmful lows. Whilst additional recognized enterprises may well be able to transform to more conventional options, this sort of as a bank bank loan or line of credit history, tiny business entrepreneurs could not have access to all those selections.

That is exactly where debt factoring arrives in. Utilizing financial debt factoring, you can offer your accounts receivables to a debt factoring company at a price reduction and get a rapid infusion of cash.

Overview: What is credit card debt factoring?

If you sell to your prospects on credit score, you probably have uncollected accounts receivable. For modest business proprietors that find them selves needing a brief infusion of cash, debt factoring can be a lifesaver.

In finance, factoring refers to a third social gathering or intermediary that contracts to purchase remarkable invoices from your company. Once you come across a factoring corporation that operates in your field, the course of action is quite straightforward.

Following filling out an application, you are all set to offer your customer’s unpaid invoices to the factoring firm, acquiring 80%-85% of the price of the bill instantly. When the buyer pays the factoring enterprise, you acquire the stability of the bill, minus the service fees charged by the factoring firm.

Credit card debt factoring is distinctive from bill discounting, which provides your enterprise with a short-phrase loan but does not buy the invoice, leaving the invoice assortment approach to you.

Factoring can supply organizations with brief funds at a sensible charge. Image source: Writer

Most debt factoring firms offer the two recourse and non-recourse factoring. Recourse factoring needs that your small business fork out the credit card debt factoring enterprise should really a purchaser not shell out an bill, even though in non-recourse factoring, you’re not demanded to repay the sum of the progress offered that the consumer has a legitimate motive for non-payment.

Lots of factoring providers also offer you spot factoring, which consists of the sale of only pick invoices to the factoring business.

Together with the concluded application, you are going to have to deliver the factoring corporation proof that you’re employing appropriate accounts receivable methods in your organization, which consists of good vetting of buyers and timely invoicing. Supplying this information must be a easy approach if you are applying excellent accounting software.

Right before signing any contract or agreement, you must have an understanding of exactly how personal debt factoring operates, as perfectly as the strengths and drawbacks of making use of a personal debt factoring firm.

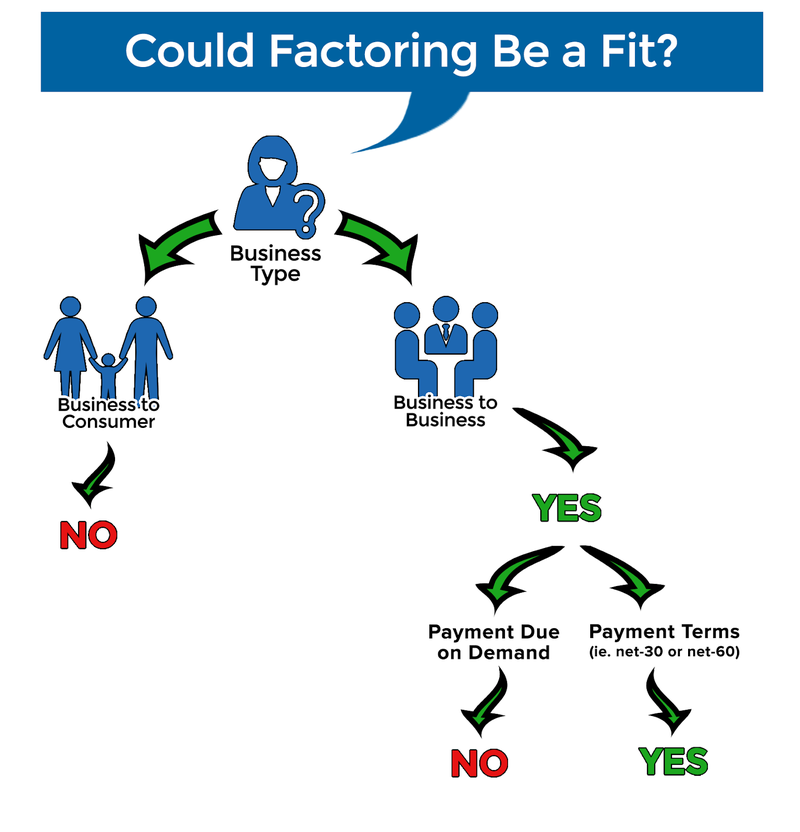

Depending on the form of company you individual, factoring might not be an choice. Picture resource: Author

Strengths of personal debt factoring

For little corporations, personal debt factoring can be a lifesaver, specifically in the early a long time when funds flow can be problematic. Using a debt factoring firm can assistance with all those occasional funds circulation difficulties though also giving your organization with more cash that can be applied for expanding the small business or even hiring more staff members. Look at out these other methods that your organization can reward from employing financial debt factoring.

Features swift hard cash

Even if your tiny company qualifies for a financial loan, odds are it can acquire weeks to have the money in-hand. Credit card debt factoring moves significantly more quickly than a classic mortgage, with most companies equipped to have income in-hand in less than 48 hrs. This can be specially important if you require money for an urgent make a difference such as covering payroll.

Expands your customer base

If you’ve been hesitant to present your consumers credit rating terms entirely simply because of the payment turnaround time, debt factoring can enable. As soon as you provide merchandise to your shoppers on credit rating and the credit card debt factoring enterprise approves the invoice, you will see the payment in times, with the financial debt factoring business liable for amassing the harmony. This will allow you to increase your shopper foundation by supplying them a lot more favorable terms.

Possibly saves you income

Running accounts receivable can be a whole-time position. If you’re discovering the risk of hiring an accounts receivable clerk to handle invoices, observe up with late-paying clients, and get started assortment processes, you may preserve cash by applying a factoring firm instead.

Which is simply because the financial debt factoring company handles all accounts receivable management once an invoice has been designed, like all payment observe-up and collection, which could expense you significantly less than the salary of a comprehensive-time accounts receivable clerk.

Negatives of credit card debt factoring

As you can see, little organizations might uncover it beneficial to use a credit card debt factoring corporation. But there are also some downsides to contracting with a factoring firm that you have to have to be aware of.

Not an solution for money enterprises

If your organization is mostly providing to shoppers that pay back instantly, debt factoring is not an solution, since debt factoring involves early payment of invoices with phrases of Net 30 or for a longer period.

You however need to have to do a credit rating verify on your customers

Financial debt factoring is not as easy as handing in excess of purchaser invoices that are thanks. You continue to want to vet your consumers in advance of selling to them on credit, since personal debt factoring firms do not acknowledge all invoices. If your customers don’t have good credit, odds are the factoring enterprise will reject the bill that you’re striving to sell.

A different explanation why you’ll need to have to test your customer’s credit score is that a slow-paying purchaser will value you much more dollars because factoring service fees are calculated based mostly on the times the invoice stays exceptional.

It can deal with up small business inefficiencies

If your organization is chronically small of dollars, debt factoring can enable in the limited term, but you are going to have to discover the motive why you are not bringing in plenty of revenue to address your business enterprise expenditures. Are you around-staffed? Have your revenue dropped? Are you having to pay also substantially lease? These are extensive-expression issues that will want to be tackled. Using credit card debt factoring will only offer a shorter-phrase resolution.

How to discover a reputable personal debt factoring company

There are a whole lot of personal debt factoring businesses out there. How do you know which one to choose? Very first and foremost, you are going to want to obtain a reliable firm that will offer you obtain to consumer references and fees reasonable prices. If you are not guaranteed where by to start out, these recommendations may perhaps enable.

1. Do some initial study

There are a good deal of assets

out there online to assistance you get began in your search for a debt factoring company. Doing some preliminary exploration can assist slim your options down. When you do, you can start undertaking a further dive into the remaining organizations, such as their personal debt factoring knowledge, how extensive they’ve been in business, and their fees.

2. Function with a factoring broker

A factoring broker can acquire some of the confusion out of finding the personal debt factoring enterprise that may be ideal for your enterprise. A factoring broker functions like an insurance or home loan broker, browsing numerous possibilities to discover the enterprise that might be suitable for your company. The factoring enterprise normally pays a fee to the factoring broker, so there is no price to you.

3. Request a whole lot of queries

As soon as you do discover a factoring enterprise, be certain to question a great deal of questions before signing a deal. You’ll want to get responses to the pursuing:

- How extensive they’ve been in enterprise

- What factoring options they provide

- What industries (if any) they specialize in

- What their premiums are

- How immediately you can get your revenue

- If they require every month minimums

Be certain you expend the necessary time to acquire the answers to all of your issues.

4. Test references

At the time you do choose out a pair of debt factoring corporations, make confident that you receive references from every single business and in fact simply call people references.

Greatest techniques when financial debt factoring

As soon as you decide to use financial debt factoring in your enterprise, there are some most effective methods you may possibly want to stick to.

1. Spend focus to factoring action

Do not just transform over finish handle of your accounts receivable to the personal debt factoring corporation. Keep on leading of shopper payment dates and really do not hesitate to deliver up any issues or worries you may perhaps have. In a lot of instances, it can be a uncomplicated misunderstanding, but there have been cases of financial debt factoring organizations recording payments a several times just after receipt, resulting in enhanced costs.

2. Obtain a credit card debt factoring corporation that is effective in your sector

When lots of credit card debt factoring corporations work with different firms, there are some sector gurus. If you do the job in a area of interest field, make sure you decide on a personal debt factoring company that has experience functioning in your industry.

3. Check out all of the good print before signing with a organization

Be positive to study all of the great print in advance of signing an agreement. If this is your first time using a financial debt factoring business, you will want to consider to prevent a extended-expression agreement right until you are positive that the process is doing the job favorably.

4. Look at personal debt factoring as a brief-phrase alternative

If your business enterprise is normally small of income, devote some time investigating specifically why. When factoring financial debt is a excellent small-term alternative, investigating and rectifying very long-term money stream challenges is a necessity.

Credit card debt factoring is a feasible option to non permanent hard cash move difficulties

Debt factoring can give a very good shorter-time period option for companies that have to have a brief influx of funds. Credit card debt factoring charges vary between providers with fees ranging from .5%-5% of the bill complete, producing them a a lot more inexpensive answer than a loan.

Before beginning invoice factoring, be absolutely sure to examine a wide range of personal debt factoring firms to come across the ideal match for your business enterprise.

[ad_2]

Supply connection